Contents:

https://1investing.in/ costs refer to all indirect expenses of running a business. These ongoing payments support your business but are not directly linked to creating a product or service. While both the overhead rate and direct costs can impact final product cost, along with your balance sheet and income statement, they are two different things. Storing extra products or mothballed equipment “just in case” costs tens of thousands in factory overhead. Consolidate those areas to both decrease overhead and increase alternative revenue streams.

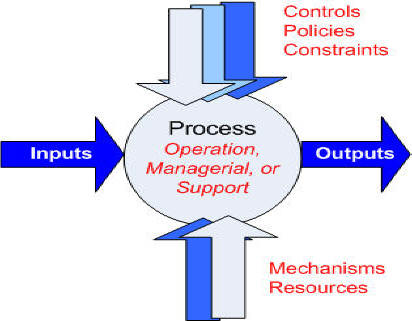

If the company can demonstrate such a relationship, they then often allocate overhead based on a formula that reflects this relationship, such as the upcoming equation. While many types of production processes could be demonstrated, let’s consider an example in which a contractor is building a home for a client. The accounting system will track direct materials, such as lumber, and direct labor, such as the wages paid to the carpenters constructing the home.

Overhead Costs (Definition and Examples)

This cost is incurred for materials which are used in manufacturing but cannot be assigned to any single product. Indirect material costs are mostly related to consumables like machine lubricants, light bulbs , and janitorial supplies. Cost accountants spread these costs over the entire inventory, since it is not possible to track the individual indirect material used.

The direct labor costs for Dinosaur Vinyl to complete Job MAC001 occur in the production and finishing departments. In the production department, two individuals each work one hour at a rate of $15 per hour, including taxes and benefits. The finishing department’s direct labor involves two individuals working one hour each at a rate of $18 per hour. The unique nature of the products manufactured in a job order costing system makes setting a price even more difficult. For each job, management typically wants to set the price higher than its production cost. Even if management is willing to price the product as a loss leader, they still need to know how much money will be lost on each product.

Note that there are a few exceptions, since some service industries do not have direct material costs, and some automated manufacturing companies do not have direct labor costs. For example, a tax accountant could use a job order costing system during tax season to trace costs. The one major difference between the home builder example and this one is that the tax accountant will not have direct material costs to track. Manufacturing overhead involves a company’s manufacturing operations. It includes the costs incurred in the manufacturing facilities other than the costs of direct materials and direct labor.

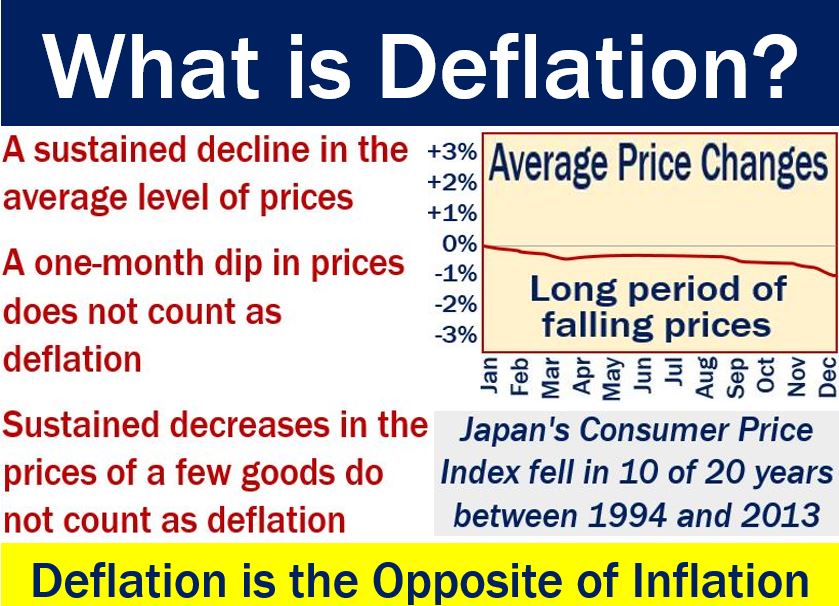

These costs remain constant regardless of production and business profit, like administrative costs, insurance costs, or rent. While this is a necessity for larger manufacturing businesses, even small businesses can benefit from calculating their overhead rate. Knowing your overhead rate is important for businesses of any size.

How to Calculate Allocated Manufacturing Overhead

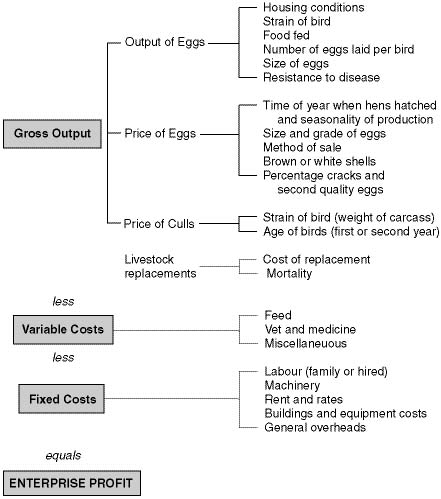

The cost of maintaining and running a manufacturing facility is significant, and these costs cannot be directly traced to a specific product or service. Sometimes factory overhead costs are called indirect costs because they are indirectly related to the products being produced. They are also called conversion costs because these are costs incurred to convert a raw material into a finished good.

General and Administrative (G&A) Expense: Definition, Examples – Investopedia

General and Administrative (G&A) Expense: Definition, Examples.

Posted: Wed, 06 Apr 2022 07:00:00 GMT [source]

What may be a direct labor cost for one company may be an indirect labor cost for another company or even for another department within the same company. Deciding whether the expense is direct or indirect depends on its task. If the employee’s work can be directly tied to the product, it is direct labor. If it is tied to the factory but not to the product, it is indirect labor. If it is tied to the marketing department, it is a sales and administrative expense, and not included in the cost of the product. Direct costs are most of the time variable in nature, while indirect costs remain constant.

The formula for overhead rate

As a investing activities include owner, you’re likely always looking for ways to reduce costs and improve your bottom line. One area that many eCommerce businesses need to pay more attention to when trying to accomplish this, however, is manufacturing overhead costs. The wages and salaries which cannot be identified with particular cost centres and cost units are indirect labour. The indirect labour is apportioned to and absorbed by cost centres and cost units. Generally, the indirect wages are paid to employees who are employed other than on production. These are the expenses incurred for management of an organisation.

SG&A: Selling, General, and Administrative Expenses – Investopedia

SG&A: Selling, General, and Administrative Expenses.

Posted: Mon, 05 Sep 2022 07:00:00 GMT [source]

Along with these direct materials and labor, the project will incur manufacturing overhead costs, such as indirect materials, indirect labor, and other miscellaneous overhead costs. Manufacturing overhead is a vital aspect of accounting in the manufacturing industry. It refers to the indirect costs incurred during the production process that cannot be traced back to specific products or services.

Before calculating the overhead rate, you first need to identify which allocation measure to use. An allocation measure is something that you use to measure your total overall costs. “Factory overhead” is how much it costs to produce a company’s products, not the labor and materials it takes to directly create the widget.

Grow your eCommerce business with SkuVault

You may think keeping track of your overhead—the cost of staying in business—is a pain. You may be tempted to believe you’re earning $3.00 income for every glass sold. But that doesn’t take into account the cost of electricity (to run your top-of-the-line juicer), or the monthly rate for your accountant . And unless you factor them in, your profit will be lower than your profit projections. Your overhead rate is how much money you spend on overhead compared to how much revenue you generate. For instance, you may have an overhead rate of 14%—meaning that, for every dollar your business brings in, you pay $0.14 in overhead.

The above phenomenon leads to create abnormal pricing of the product and a decrease in the demand for the product. Overhead is the cost of staying in business—not including COGS and COS, which each go directly into the product or service you offer. The sooner you figure out your overhead, and see how it relates to your revenue, the sooner you get a realistic portrait of your business—and the info you need to start planning for the future. When you buy ingredients for the croissants at your bakery, that expense is included in COGS.

Now let’s understand how you can calculate the overhead cost as we now know the various methods of calculating the absorption rate. As per this method, you charge overheads to production based on the number of machine-hours used on a particular job. Such a method is useful to calculate the overhead rate for operations that do not make use of large machinery.

- For example, you own a bakery and incur advertising costs to promote your bakery products.

- Sometimes factory overhead costs are called indirect costs because they are indirectly related to the products being produced.

- Another technique to classify Factory overhead is to compute it as a percentage of the prime cost .

- It is most suitable where labour constitutes the major factor of production.

Once you’ve estimated the manufacturing overhead costs for a month, you need to determine the manufacturing overhead rate. This is the percentage that you must pay for overheads every month. Rent and taxes, wages to labor, salary to production manager, direct material costs, the salary of cost control personnel, depreciation of the machinery, depreciation of the car used in logistics purpose. It incurred during the production process comes under indirect costs. If you have been wondering how to calculate overhead costs, it is simple.

Manufacturing overhead is added to the units produced within a reporting period and is the sum of all indirect costs when creating a financial statement. It is added to the cost of the final product, along with direct material and direct labor costs. In order to set an appropriate sales price for a product, companies need to know how much it costs to produce an item.

If the overheads of a machine cost centre are divided by the effective machine hours, we get machine hour rate pertaining to the machine or the group of machines. Machine hour rate is one of the methods of absorbing factory overhead. This method is commonly used in those industries where machines are primarily used because in these industries overheads are mostly concerned with machines. These three are meant for collection of indirect expenses including depreciation of plant and machinery. The overhead expenses vary depending on the nature of the business and the industry it operates in. Overhead costs are important in determining how much a company must charge for its products or services in order to generate a profit.

DepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Depreciation or amortization calculated on Fixed assets like machinery, property, Land, buildings, etc.

Manufacturing overhead is fixed in nature and is not related to the business’s number of units manufactured. In the case of overproduction, the costs of manufacturing overhead remain fixed, and thus it does not hinder the employer’s pocket. For example, Depreciation related to a production facility is fixed, no matter how much quantity is produced. In conclusion, manufacturing overhead is an important aspect of accounting that cannot be ignored. Understanding manufacturing overhead and how it is calculated, allocated, tracked, and controlled is essential for companies that operate in the manufacturing industry. By doing so, companies can improve their production processes’ efficiency and make informed pricing decisions, ultimately leading to increased profitability.